7 Tips for Maximizing Your Kiwisaver Contributions And Achieving Your Goals

Mon Sept. 18th 2023

Are you on track to buy your First Home or achieve your Retirement Goals?

Are you making the most of your KiwiSaver contributions?

KiwiSaver offers a fantastic opportunity for individuals to prepare for a comfortable retirement or buy their first home, but like any investment, the key lies in maximizing your contributions and making informed decisions.

Understanding KiwiSaver: A Quick Overview

KiwiSaver is designed to help you save for your retirement or first home. Through a combination of employee, employer, and government contributions, as well as investment returns, KiwiSaver offers a solid foundation for securing your financial future or buying your first home. Members have the flexibility to choose from a variety of investment funds tailored to their risk tolerance and financial objectives.

7 Tips for Maximizing Your Contributions and Achieving Your Goals

- Choose the Right Fund & Investment Strategy: Your choice of investment fund is a critical factor in determining the growth of your KiwiSaver savings. Consider your risk tolerance, investment timeline, and financial goals when selecting a fund. If you're unsure, contact us and we’d be happy to help you.

- Regularly Review & Adjust Your Contributions: Life circumstances change, and so should your contributions. As your income increases or your expenses decrease, consider increasing your KiwiSaver contributions. Regular reviews will help ensure your savings stay on track to meet your retirement objectives or your deposit for your first home. Click here to book a 20min KiwiSaver Review.

- Diversify Your Investments: Diversification is a key principle of investment. Consider spreading your KiwiSaver investments across different markets and asset classes to reduce risk. A well-diversified portfolio can help you weather market fluctuations more effectively and give you more consistent returns. This ensures portfolios always have some exposure to the highest returning market and asset class, whilst never being at risk of only being allocated to the lowest returning market and asset class. This is known as prudent diversification.

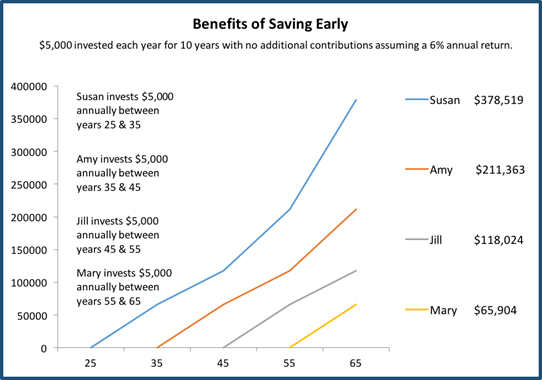

- Harness the Power of Time: Make sure your KiwiSaver is set up correctly for your goals and timeframes. Time is one of your best friends to increase your returns, and it's free. The longer you contribute, the more you'll benefit from compounding interest, which can significantly amplify your savings over the years.

Take Advantage of Employer & Government Contributions: Make sure you’re getting the maximum you can from your employer by contributing 3% and contributing at least $1043 by end of June every 12 months. This is essentially free money that can significantly boost your savings for retirement or first home purchase.

If you’re working part-time or not working, to get to the $1043, you can make voluntary contributions via online banking. This will help you to get the $521 from the government annually.

Voluntary contributions can also be particularly beneficial if you're looking to fast-track your retirement savings or make up for lost time. Over time, you’ll see the power of compounding interest where you’ll see interest on interest paid into your account.

- Stay Informed about Scheme Changes: KiwiSaver regulations and benefits may evolve over time. It's essential to stay informed about any changes to the scheme that could impact your savings.

- Plan Today for a Secure Tomorrow: By implementing these strategies and staying informed about the scheme's changes, you'll be taking the right steps towards maximizing your contributions and achieving your retirement goals or purchasing your first home.

Click here to review your KiwiSaver Fund today to discover how to maximize returns and achieve your long-term goals.

Remember, the decisions you make today can have a profound impact on your financial future. Whether you're just starting your KiwiSaver journey or have been a member for years, it's never too late to optimize your approach and secure the retirement you deserve!

Need our help?

We're here to answer your questions.

service@cavefinancial.co.nz

09 302 7310

1D Roberta Avenue

Glendowie

Auckland 1071

New Zealand